Credit cards are filled with all sorts of benefits, including things like car insurance and travel credits, along with extended warranty and price protection, but the average cardholder probably never bothers to use them. Most are likely drawn to a particular card for its large sign-up bonus, or perhaps the cash back earning capabilities, or… Continue reading Credit Card Price Protection Actually Works, Seriously

U.S. Bank Altitude Reserve: Earn 3X on Travel and Mobile Wallet Purchases

The latest luxury credit card to join the fray is the “U.S. Bank Altitude Reserve card,” which is expected to be released in early May, but already has a bit of hype behind it. While U.S. Bank isn’t a major player in the credit card world, they do seem to recognize the value of getting… Continue reading U.S. Bank Altitude Reserve: Earn 3X on Travel and Mobile Wallet Purchases

Alliant Visa Signature Credit Card Offers 3% Cash Back First Year, 2.5% Thereafter

There’s a new 2.5% cash back credit card on the block that comes with 3% cash back on all purchases the first year. The “Alliant Visa Signature Credit Card” from the Alliant Credit Union is currently available for “select Alliant members,” but will be available to “all” come April. It’s only the second credit card… Continue reading Alliant Visa Signature Credit Card Offers 3% Cash Back First Year, 2.5% Thereafter

Uber Credit Card Review: 4% Cash Back on Dining, 3% on Travel, 2% on Uber

Update: It has now been confirmed that an Uber credit card is being released on November 2nd, 2017 by Barclaycard, per Uber themselves. We now have all the important details on the exciting new Uber Visa Card, including some tasty bonus categories and a sign-up bonus. Below is my review of the new Uber credit… Continue reading Uber Credit Card Review: 4% Cash Back on Dining, 3% on Travel, 2% on Uber

Just a Few More Days to Snag a Credit Card Triple Dip

Ever heard of a “credit card triple dip?” While it might take on several meanings, the one I’m referring to takes advantage of calendar-year benefits. What Is a Credit Card Triple Dip? In a nutshell, you can get up to three calendar year benefits while paying only a single annual fee. For example, the Chase… Continue reading Just a Few More Days to Snag a Credit Card Triple Dip

Should I Add an Authorized User to My Credit Card Account?

Credit card Q&A: “Should I add an authorized user to my credit card account?” These days, credit card companies are constantly urging us to add an authorized user. In fact, they’re even incentivizing us to do, offering 5,000 bonus points in many cases. For example, Chase Sapphire Preferred card holders can get an additional 5,000… Continue reading Should I Add an Authorized User to My Credit Card Account?

Chase Ultimate Rewards Points vs. Amex Membership Rewards

If you’re in the market for a new rewards credit card, you’ve probably compared options from Chase and American Express, as they offer the biggest sign-up bonuses out there. But their rewards points are very different, so you can’t just say one is offering more points and is therefore the better option. Instead, you need… Continue reading Chase Ultimate Rewards Points vs. Amex Membership Rewards

Are You Better Off Paying Fees to Meet Minimum Credit Card Spend?

I’ve been working on some minimum spend lately, thanks to a new Chase Ink card and the Chase Sapphire Reserve. Those two cards mean I have to spend $9,000 in the span of 90 days, which can be a bit harrowing for some and a breeze for others. Once I was approved, and had yet… Continue reading Are You Better Off Paying Fees to Meet Minimum Credit Card Spend?

Chase Ink Business Preferred Review: 80k Sign-Up Bonus

News just broke of yet another new credit card from Chase, the “Chase Ink Business Preferred,” which is now available with an impressive 80,000-point sign-up bonus! It’s a latest version of the existing Chase Ink card, so nothing too mind-blowing, but a new product means a new sign-up bonus opportunity for those looking for a… Continue reading Chase Ink Business Preferred Review: 80k Sign-Up Bonus

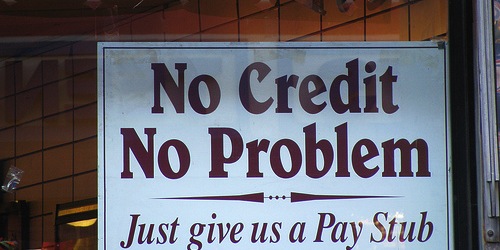

Affirm Offers New Way to Pay for Those Who Don’t Like Credit Cards

A company by the name of Affirm is looking to shake up the way consumers pay for high-ticket items they would normally just charge to a credit card. Instead of swiping or dipping, individuals can get real-time financing for purchases during the checkout process. How Affirm Works For example, if a certain Millennial (I didn’t… Continue reading Affirm Offers New Way to Pay for Those Who Don’t Like Credit Cards