It’s one thing to order a free credit report, and another to actually understand what it all means. This article aims to teach you how to properly read a credit report.

Anyone can go online and order a free credit report from the credit bureaus, but how many people actually know how to read their credit report? The answer: Not many.

Most Consumers Just Focus on Their Credit Score

Most people order a credit report from one of the three bureaus, pay for their credit score, and then conclude that they have bad credit or excellent credit, based solely on the three-digit score. To this effect, very little gets accomplished. You need to actually understand what’s on your credit report to make any sense of your credit score and its relative worth.

Many seem to think their credit score is the end-all when it comes to determining whether they have good credit or bad credit. But a seemingly great credit score will mean very little if there isn’t enough credit history to support large amounts of debt, or a decent number of tradelines to qualify for certain types of loans.

Take for instance a consumer who has a single credit card that they’ve paid on time each month for the past five years. They may have a good credit score because they’ve got no derogatory accounts, but with only one credit card to their name, and no other loans, their credit depth would be considered very shallow. So anyone thinking about offering them a sizable loan would probably think twice despite the relatively high credit score.

That warning aside, let’s look at what a credit report consists of. Please note that the structure and contents below may be presented in another order on different credit reports, and that no two credit reports are the same. There are hundreds, if not thousands of different credit reporting agencies that each have their own unique formats.

Borrower/Spouse Information

The information on the top of the first page of a credit report will include the borrower name, current address, social security number, and date of birth. It will also include the information of a spouse if it’s a joint credit report.

Credit Report Summary

The next section will show the summary of the credit report, including all three credit bureau scores (if it’s a tri-merge credit report), late payment history for the past 24 months, total number of tradelines, tradeline history, total available credit, and the total percentage of available credit. This section is a quick way to see what your mid-score is, how many late payments you have (if any), how much credit you have, and what percentage of that credit is available.

Pubic Records

This section is usually followed by a public records section, which will display any judgments, tax liens, or bankruptcies. It’s important to note the accuracy of anything in this section, as these items can have a major impact on your credit score and can play a key role in determining whether you’re eligible for all types of important financing.

Mortgages

The following section displays any mortgage information if applicable. It will include both derogatory accounts and accounts in good standing. Beginning in this section, you’ll see a series of columns with specific information detailing each tradeline:

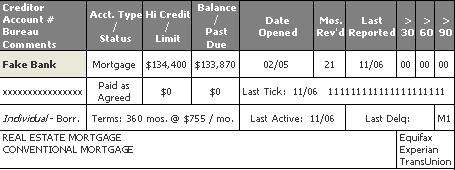

If you read from left to right, you’ll see that the box above displays the name of the creditor (Fake Bank), the account number, whether it is an individual or joint account, and the account type. The next column displays the account type and the status. The status describes whether it is “paid as agreed” or late. The next column shows the highest the balance has been historically, and the total credit limit. The following column shows the current balance and any past due amount. Below all those columns are the terms, which include the payment amount per month and the total months if it is an installment account.

In the section to the right we see the history of the account. The first column shows the date the account was opened, followed by the months it has been reviewed, and then three columns, one for 30-day lates, one for 60-day lates, and one for 90-day lates. Under each column you will see a number, which indicates the number of late payments by type. If the account is in good standing and never delinquent, you will see all zeros.

You will also see the payment history next to each tradeline, which shows a tick for each month the account has been reviewed, ranging from 1-9. You will see a “1” if the account is paid as agreed, a “2” if the account is late 30 days, and a “9” if the account is a charge-off.

Below those ticks you’ll see a date showing when the account was last active, last delinquent, and a code such as M1, R1, I1, which signifies the account type, ranging from mortgage, to revolving or installment.

The bottom corner contains the final bit of information, which details which of the three credit reporting bureaus is reporting the specific tradeline. Sometimes you’ll see all three, but in many cases only one or two of the bureaus report each tradeline. That’s why it is important to order a tri-merge credit report that shows information from all the bureaus. If you order a single-bureau report you may miss accounts and information that could have a huge effect on your overall credit profile.

Consumer Tradelines

This is usually made up of two sections, each containing all your consumer tradelines that aren’t mortgages, including auto loans, credit cards, collections, charge-offs, and other lines of credit.

The first section should display the accounts that are derogatory, and the second section should show the accounts that are in good standing. The format should be the same as the mortgage section, with the numerous details I mentioned above.

Credit Risk Score / Explanations

This section shows more detailed information from all three credit bureaus, detailing why the credit score is reporting at a certain level. Here you’ll see comments from each bureau, ranging from something such as “length of time accounts have been established” to “too many credit inquiries in past 12 months”.

Credit Inquiries

This section lists any recent credit inquiries, including the date, creditor, loan type, and bureau(s) reporting it. You may see the inquiries separated into two sections, one for “hard inquiries” and another for “soft inquiries.”

Hard inquiries are notifications that you applied for some form of credit, and thus they may count against you. Soft inquiries are not applications for credit, such as background checks or free credit scores/reports, and do not count against you.

If you see a large amount of hard inquiries from all types of different creditors for different transactions, your credit score was probably adversely affected as a result.

While it doesn’t hurt to have your credit pulled by multiple, like lenders when shopping for one loan, if you have multiple inquiries from unrelated creditors, it can send out a warning to other creditors that you’re desperately or aggressively trying to borrow. This will lower your credit score.

*A credit check does not hurt your credit score if you order it yourself.

Alerts

This section shows any discrepancies the credit bureaus might report, such as social security issues or fraud alerts.

Aliases

This section shows any other aliases known to the credit bureaus for the social security number you use to pull the credit report. Though you may go by different names, the credit bureaus will likely gather your information based on social security number, not nickname or married name.

Address History

This section just shows a hierarchical list of where you may have lived in the past decade.

Employment History

This section is important, as it shows a list of past and present employers. This section can be viewed by underwriters to determine if you have job stability, or if you really earn what you claim.

Credit Bureau Contact Information

The final section of most credit reports lists the three credit bureaus’ addresses and phone numbers. It’s a convenient place to find contact info if you need to dispute anything with the credit bureaus.

So grab your credit report and view it alongside this guide and you should be able to read your credit report much more effectively!

Note: The free credit report from the government does not contain a free credit score. You can only obtain your credit scores by signing up for a free trial credit monitoring program, such as Credit Karma or Credit Sesame, or by paying for them individually.

(photo: Wiertz Sébastien)

- Make Sure You Have a Premium Chase Credit Card so You Can Transfer Points! - February 21, 2025

- Do Capital One Credit Cards Have a 5/24 Rule Too? - February 23, 2023

- Quickly See the Many Ways You Can Use American Express Membership Rewards Points - February 21, 2023