You can shun credit cards all you want, but understand that more than half of consumers get things started with a credit card. That’s right; a new study from FICO, the brains behind the ubiquitous FICO score, revealed that 50.1% of the population (in the study) opened a bankcard before any other type of account.… Continue reading For Most Consumers a Credit Card Is Their First Line of Credit

Category: Credit Help and Tips

Master your credit card and credit score, all in one convenient place.

Changing Your Credit Card Due Date

These days, credit card issuers allow their cardmembers to do all sorts of neat stuff, though much of it isn’t advertised or widely known to the public. One such feature many issuers offer is the ability to choose your own credit card due date, or change your existing credit card due date. Why Change Your… Continue reading Changing Your Credit Card Due Date

Maxing Out Your Credit Card Can Be Nearly as Bad as a Missed Payment

Credit cards are powerful financial tools, but also require a lot of responsibility. After all, they are often a key credit-building block for consumers, even though you don’t technically need a credit card to build credit (thanks Dave Ramsey). For this reason, and many others, it’s important to manage your credit card(s) sensibly, making on-time… Continue reading Maxing Out Your Credit Card Can Be Nearly as Bad as a Missed Payment

The Credit Score Impact of a Missed Credit Card Payment

To miss a credit card payment is to be human, as the saying goes. Okay, that’s not really a saying, but I think most of us have missed a payment at least once in our lives. For some, it’s learning a lesson, while for others it may just be out of necessity. Heck, there are… Continue reading The Credit Score Impact of a Missed Credit Card Payment

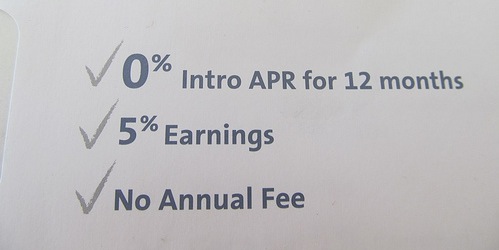

Introductory APR: Why Do Credit Card Issuers Offer It?

When searching for an appropriate credit card, there’s plenty to take note of to ensure you get what you’re looking for. Or better yet, what you need. One of the most important features of a credit card is the APR, or annual percentage rate. Put simply, the APR is the interest rate for your shiny… Continue reading Introductory APR: Why Do Credit Card Issuers Offer It?

Should You Pay Off Your Credit Card In Full?

Credit Card Q&A: “Should you pay off your credit card in full?” While this may sound like an absolute no-brainer, it’s clear that many people still don’t know the answer to this very fundamental question. First a little background on how credit cards work. When you apply and get approved for a credit card, it… Continue reading Should You Pay Off Your Credit Card In Full?

Maintaining a Credit Card Balance Doesn’t Help Your Credit Score

File this one under deadly credit scoring myths. For some reason, probably due to the clandestine nature of Fico’s credit scoring algorithm, many consumers believe carrying a balance on a credit card will benefit their credit score somehow. This can’t be further from the truth, and in reality, can be quite detrimental to one’s finances.… Continue reading Maintaining a Credit Card Balance Doesn’t Help Your Credit Score

Do You Need a Credit Card to Build Credit History?

Credit Q&A: “Do you need a credit card to build credit?” Being credit score conscious seems to be all the rage these days, along with being green and reducing your carbon footprint. It seems everyone is now obsessed with their credit score, which isn’t necessarily a bad thing. The only downside is the misinformation that… Continue reading Do You Need a Credit Card to Build Credit History?

What Credit Card Approves Everyone?

Credit card Q&A: “What credit card approves everyone?” Ah yes, the age-old question, typically asked by someone with a less than perfect credit score. Well, without further ado, prepaid credit cards do not require approval. That’s right. 100% approval folks! But that’s not necessarily a good thing, or anything special. Why do you think financial… Continue reading What Credit Card Approves Everyone?

Debit Card vs. Credit Card

Credit cards aren’t for everyone. Some people simply aren’t responsible enough to carry credit cards. And others may not have the credit history necessary to obtain one. Then there are those that just like to use cash. Of course, banks know this, which is one of the major reasons why they offer debit cards. If… Continue reading Debit Card vs. Credit Card